Electronic Payment Systems (EPS) are now widely used for a variety of transport applications. For example:

EPS offers major advantages over cash payment:

EPS already plays an important part in the development of integrated transport policies (See Policy Framework Analysis). The planning of individual EPS schemes requires:

The harmonisation and interoperability of electronic payment systems can support the development of multi-modal, integrated transport – but there are significant challenges in integrating payment systems and data exchange between separate organisations. Essential factors that need to be addressed when implementing EPS across multiple services include:

All EPS require efficient and effective Back-Office arrangements to:

EPS is a powerful way of introducing travel demand management and other transport, social and environmental policy objectives – such as selective charging of HGVs which cause disproportionate damage to the roads compared to other vehicles. In the long-term, as public acceptance of EPS grows, its use could be extended to other areas. For example EPS could be used to replace taxes on vehicle ownership and usage (such as fuel tax) with charges that vary according to the time, distance travelled and the places where a vehicle is driven (See Future Trends). Videos: How Electronic Tolling Works and Interoperable Electronic Toll Collection( ETC) on NH-8

Electronic Payment Systems (EPS) provide a convenient, secure and auditable means of paying for different transport services and offer major advantages over cash payment for transport and highway operators, their passengers and customers, including:

Electronic payment benefits travellers and operators whilst speeding up the payment process, improves the efficiency of payment processes that were formerly cash-based and provides convenience for users of public transport. Electronic payment enables new business models, for example Electronic Toll Collection (ETC) no longer has to be considered as a means of improving efficiencies at toll plazas alongside cash and card-paying customers, but instead toll roads can now be designed exclusively for ETC operation, eliminating the need for toll plazas and allowing vehicles to pay tolls without having to slow down or stop.

Electronic payment applications are enabled by a variety of technologies including smart cards, RF tags and mobile phones. The principal applications are as follows:

Videos: How Electronic Tolling Works & Interoperable Electronic Toll Collection( ETC) on NH-8

The reason why a route may be tolled is most often to recover some or all of the costs of construction, operation and maintenance of roads, bridges, and tunnels. Tolls collected are:

Part of the revenue collection process can be automated to improve operating efficiencies and reduce the operating cost of toll collection by means of Electronic Toll Collection (ETC). Prior to the introduction of ETC tolls were collected manually – involving the construction of large “toll plazas” on motorways with multiple toll booths.

ETC is now an established means of payment for road usage – and ETC may be offered alongside cash and cards at a toll plaza. When a high proportion of vehicles are equipped for electronic payment, it is feasible to provide ETC as the only means of payment – in which case, toll plazas may not be required at all.

ETC needs to be supported by an adequate legal framework and enforcement processes. It may make use of:

To be efficient, a toll collection facility should accept several Means of Payment (MOP), including cash and credit cards. Toll plazas may be used as an effective means of regulating vehicle flow to ensure that the drivers of all vehicles provide a valid payment or provide some evidence that they are exempt from tolls. Since its first commercial application in October 1987, ETC has been accepted worldwide as an additional means of payment since it is a highly reliable, efficient and accurate way of tolling that offers convenience since drivers do not have to stop to pay. ETC also provides a higher throughput compared to other means of payment. ETC is found in almost every country with a mature road network such as Australia, China, Colombia, France, India, Mozambique, Norway, South Africa, Spain and the US, amongst many others. Video: Interoperable Electronic Toll Collection( ETC) on NH-8

Typically, the technologies for ETC include vehicle detection, classification and some form of account identification such as:

As vehicle demand increases, the capacity of a toll plaza must also increase – either by adding new toll lanes or by increasing the throughput of existing lanes. This can be done by adding ETC capability with incentive discounts. Ideally the ETC will be interoperable with other toll collection facilities to:

As demand increases yet further – or if there are constraints on land usage for toll plazas – it may be necessary to consider implementing Multi-lane Free-flow (MLFF) tolling which reduces or removes completely the requirement for toll plazas. MLFF will increase the speed and volume of vehicle throughput but requires robust enforcement mechanisms. Video: Gantry installation at the Dartford Crossing - time-lapse

Plaza-based Electronic Toll Collection, Taiwan

Multi-Lane Free Flow Electronic Toll Collection, South Africa

Toll collection is a highly standardised process. Using ETC it can be automated to improve operational efficiency and minimise the cost of processing every vehicle passage. For drivers to experience the benefits of non-stop payment of tolls, a sufficient number of lanes need to be equipped with vehicle detection and classification technology and ETC readers, supported by an enforcement system (See Back Office/Enforcement). As demand increases more lanes on each toll plaza can be equipped with ETC. Some lanes can offer multiple Means of Payment (MOP) – manual and ETC with other lanes dedicated to ETC only.

Where it is not possible to create space for a toll plaza (for example, in an urban environment or where it is not practical to disrupt the flow of traffic on an existing motorway), Multi-lane Free Flow (MLFF) tolling may be used. This:

In all cases, if compliance checks fail, enforcement is necessary using the images captured by the cameras (See Back Office/Enforcement). To maximise accessibility, users that still wish to pay by cash or credit card may be given the option of paying at retail outlets or via the Internet. Similarly occasional users may be able to register for a video tolling account – although a premium may be applied to reflect the additional cost of processing video images compared with more accurate, lower error tag-based transactions.

There are examples of MLFF systems in Australia, Canada, Chile, New Zealand and the US – with more recent introductions in China, Ireland and South Africa. Each of these uses either RFID or DSRC tags as the primary Means of Payment (MOP) and offer video tolling as a secondary solution.

Advances in satellite positioning mean that tolls can now be calculated based on the time, distance travelled or the location of the vehicle on the road network. These are measured using an On-board Unit (OBU) that has the capabilities to estimate its own position via Global Navigation Satellite System (GNSS) and to communicate this information over a Cellular Network (CN). A GNSS/CN-based scheme is an advanced method of tolling and is used in some countries for HGV tolling (See Heavy Good Vehicle Tolling).

ETC provides the opportunity to automatically link a vehicle with an account that is to be charged with the required tolls. This improvement in efficiency benefits road users and toll road operators by reducing congestion, reducing harmful emissions and improving throughput. The tolling policy, security issues, construction and operating costs and other constraints such as the availability of land will determine which is the most appropriate deployment strategy and technology to use:

As the usage of ETC increases, the need to collect payments in cash reduces. The cost of investing in ETC systems is high. Inevitably, there will be improvements in technology over time (for example, mobile phone payment, contactless payment cards) with the risk that that a tolling solution may be overtaken. Improvements in performance and reductions in cost (particularly of tags and On-Board Units) may offer long-term operational benefits – to the extent that an upgrade may need to be considered.

Procuring RFID or DSRC systems that comply with standards make it easier to have a broader choice of suppliers and avoid “technology lock-in”. A periodic review of technology options will help to inform the scope and potential cost of a replacement system or upgrade to the current technologies.

From an operational perspective, it may be a good idea to move away from each toll operator maintaining its own back-office. A separation of ETC account management from other aspects of tolling operations – as demonstrated in Europe (Ireland) – can encourage the emergence of specialised back-office support able to service a number of different operators, with corresponding efficiency savings (See Standardisation & Interoperability).

ETC has been proven to be a viable means of automating toll collection in developed and developing economies. If cash payments for tolls are an accepted form of payment en-route, a toll plaza is needed. These can offer a range of Methods of Payment (MOP), including ETC. The enforcement strategy could include a barrier or a traffic light that prompts road users to present a valid MOP on entry to, or exit from, a tolled route (See Back Office/Enforcement).

For occasional users, video tolling could be offered. Where an accurate national register of vehicles exists, it becomes possible to operate toll lanes without barriers – since the register enables association of a vehicle and its number plate with a specific person or company. Instead of barriers, cameras can be used to capture images of evidential-quality to prove that the vehicle was present for enforcement purposes.

If the public acceptability for tolls is low, and the risk of payment evasion is high – a barrier to control the flow of vehicles is likely to be the most practical option, even if an accurate vehicle register exists.

A Heavy Goods Vehicle (HGV) is more likely to travel longer distances than a light goods vehicle – in some cases crossing borders and travelling through countries to reach distant customers. Tolling of heavy goods vehicles is aimed at regulating their use of roads. It helps ensure that HGVs pay a contribution towards the cost of providing and maintaining the road infrastructure they use – even if vehicles are registered in other countries. Taxes and charges are most commonly levied on the basis of distances travelled and annual permits. Its deployment may be limited to a strategic road network or apply to all roads.

The first use of taxing HGVs for distance travelled, was in New Zealand in 1975. Since then, the practical implementation of regulating HGVs use of roads by means of taxes and charges has evolved significantly and can be based on route and time of travel as well as distance travelled. The requirements for accuracy of charging and the enforceability of schemes have evolved to the point that HGV charging is now a proven ITS application – technically and operationally.

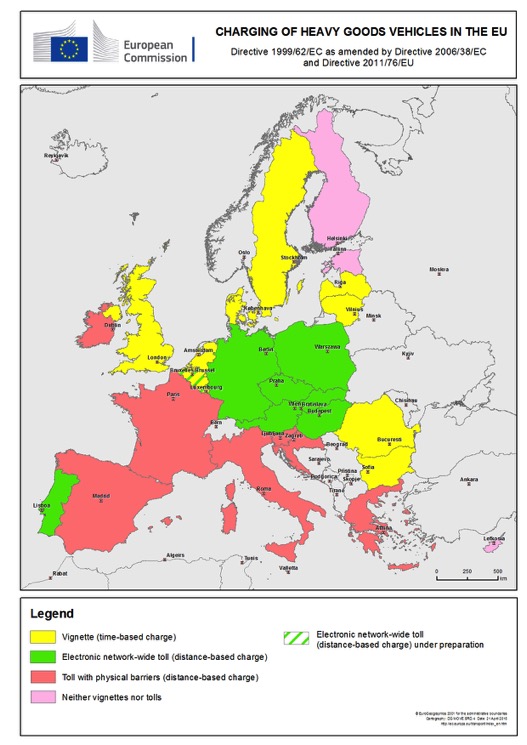

Globally, the densest networks of actively regulated HGVs are in the European Union – as illustrated in the figure below. This includes the UK, where the HGV levy was introduced in April 2014. Elsewhere in Europe, Switzerland and Norway have implemented schemes – and there are other examples in Australia, North America and sub-Saharan Africa. Transit nations such as Austria, Germany, Namibia and Switzerland have developed their own regulations based on some mix of road types, time and distance, with variations of charges depending on emissions class of the vehicle.

Charging of Heavy Goods Vehicles in the EU (as of 2015) Source: European Commission

HGV tolling does not depend on the existence of a general ETC tolling regime for all vehicles – but can make use of it.

Most commonly, an HGV tolling policy is stand-alone (such as in Austria, Germany, Namibia and Switzerland) – but where part of the road network already imposes tolls on all vehicles, HGV tolling can be integrated into a general tolling policy (such as in the USA). The tolling policy defines the operational strategy and technology requirements. In all cases, there needs to be:

HGV tolling can be achieved by:

The relatively low cost of tags and roadside identification systems suits an HGV scheme that has a very limited number of roads or border crossings (See Methods of Payment). On Board Units (OBUs), able to determine vehicle location via Global Navigation Satellite Systems (GNSS) allow an HGV tolling scheme to be deployed on a much larger road network and enable differentiation of charges according to type of road or other factors.

The vehicle location technologies used in ETC also support other objectives – such as the management of HGVs conveying hazardous materials (‘Hazmat’), fleet management, cross-border pre-clearance, cabotage regulation, and detection and enforcement of overweight vehicles (See Freight and Commercial Services).

Charges may also vary according to a HGV’s emission class or other factors. Examples include:

The starting point of some of the HGV charging schemes (for example, Switzerland, Germany and the Czech Republic) was a paper ‘vignette’ (a time-based permit) that was displayed in the windscreen of vehicles that used the main road network. The labels are designed to be checked manually but some are not very secure since they can be modified or forged. The UK scheme uses the vehicle’s number plate to check whether a vignette has been paid (recorded on a central database) – rather than a paper sticker. Alternatively:

A back office is needed to manage the database of HGVs and enforcement operations (See Back Office/Enforcement). If charges are not related to usage, an annual charge can be levied on all HGVs (for example, the UK’s HGV Levy). Compliant vehicles can be confirmed by comparing vehicle number plates with a centrally held database of vehicles and payments made.

The cost and time to register HGVs for tolling should not be underestimated. It is recommended that sufficient vehicles are registered before HGV tolling commences – to reduce the initial strain on the enforcement operations. Compliance checking may always require some combination of mobile inspectors and unmanned, static roadside systems. Static systems can operate at lower cost with higher accuracy on busy roads compared with manual checks. Occasional users may be able to register manually for every trip (such as in Germany).

HGV tolling exists in many forms – from vignettes to GNSS-based schemes with static enforcement and mobile inspection teams. All European HGV tolling schemes that have migrated from a vignette system to HGV tolling have chosen DSRC, GNSS or some combination of these, supported by fixed and mobile enforcement. The unit cost of a GNSS-based OBU is higher than an RFID or DSRC tag – but the initial cost must be weighed against the cost of operations and the number and type of roads to be tolled.

Migration is feasible:

The adoption of standards or harmonisation of systems provides flexibility for migration – particularly in relation to the format of vehicle number plates and account details from tags and GNSS-based OBUs. Periodic monitoring of new technologies (and standards) to help plan for the long-term, is recommended.

Cross-border HGV movements bring their own challenges:

Various solutions exist:

NZ Transport Agency, 2013. Road User Charges, NZ Transport Agency, New Zealand Government

Swiss Federal Department of Finance (Switzerland): http://www.ezv.admin.ch/zollinfo_firmen/04020/04204/04208/

German LKW Maut scheme operator: http://www.toll-collect.de

Transport for London (UK): www.tfl.gov.uk/lez

Port of Los Angeles: http://www.portoflosangeles.org/ctp/ctp_portcheck.asp

Road Fund Administration (Namibia): http://www.rfanam.com.na

Pickford A. and Blythe P. (2006) Road User Charging and Electronic Toll Collection, Ch2, Artech House, Boston (USA) and London (UK)

New Zealand Government. Road User Charges Act, 1977.

Congestion charging, also known as ‘Congestion Pricing’ relies on charging to manage traffic demand in a congested area – for example, a Central Business District (CBD) and other well-defined area. The objective is to keep traffic demand under control with a balance between alternative transport modes. A major benefit for drivers is more consistent journey times (See Case Study – Congestion Charging).

Electronic charging for these purposes should be implemented in a way which minimises any wider negative impacts on other modes transporting people and goods through the congestion charge zone – since this could reduce economic activity within the zone.

Reducing traffic demand can free-up road capacity for reallocation to support other transport priorities – such as public transport (such as bus lanes), pedestrians (allowing longer green times at crossings) and cycling (dedicated or mixed-use facilities). This needs careful consideration and assessment of impacts since it can lead to unintended negative effects. For instance, any reallocation of the road space, reduces the residual space available to vehicles that have paid a congestion charge and could result in an increase in their journey time. This would be contrary to the initial objectives of the congestion charging policy.

Where the core policy is demand management – charges may be differentiated by congestion, vehicle type, time-of-day and other factors. Additional policies may include the reduction of emissions – in which case congestion charges will need to be differentiated by vehicle emissions as well.

The options for implementing congestion charging include:

Since congestion charging is usually introduced onto an existing road network, it needs to be accompanied by:

A congestion charge may be unpopular with road users although the level of support may increase once the benefits have been sufficiently demonstrated (such as in Stockholm). A successful policy needs to be:

The operational strategy must support these goals. The objectives must be realistic and achievable – and measures of performance reported publicly at frequent intervals to retain public support. Alternative approaches to achieving them could include:

The number of road users willing to pay a fee to access a route or area will vary with changing fee levels. This is known as the ‘Price Elasticity of Demand’ (PED). A low PED means that a variable pricing policy is less efficient:

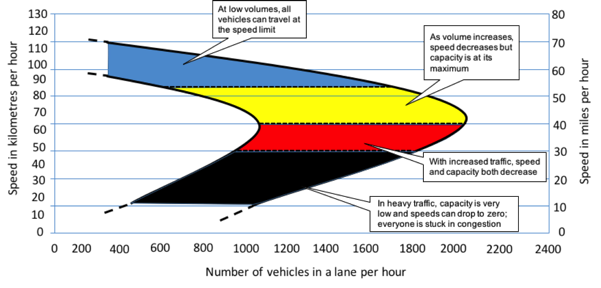

The relationship between the speed of vehicles and the number of vehicles that pass a given point in an hour is known as a ‘backward bending curve’. It is illustrated in the speed-flow diagram below – and demonstrates that a reduction in demand (caused by imposing a fee) has the effect of increasing road capacity and speed. Since it is usually the peak load traffic that causes congestion, it doesn't necessarily require a huge traffic reduction to increase the traffic flow substantially. In light traffic, all vehicles can travel at similar speeds in free flow conditions but as the volume of traffic increases the speed decreases. As the traffic increases further, the speed and capacity both decrease until road users are stuck in congestion.

Speed–flow diagram, based on USDOT data

The relationship between price and demand is at the heart of the policy of congestion charging, as shown in Singapore, London (UK), Gothenburg and Stockholm (Sweden).

Figure 5: Roadside system - Congestion Tax, Stockholm, Sweden.

A vehicle may be identified by its number plate (read by one or more cameras) on entry to, and exit from, and within, a regulated area or defined route. Most commonly, reading a vehicle’s number plate will be sufficient to record a vehicle’s presence and to help match it with a payment (such as the systems in Stockholm and London). Alternatively:

Typically, compliance is based on a vehicle being fitted with a valid tag, OBU or a number plate that is associated with a pre-paid account.

Images of non-compliant vehicles may be used as evidence for enforcement purposes – although users may be given a short period of grace during which they can pay the charges before any penalties or legal processes are started. As with tolling (See Toll Collection), a back office and enforcement processes are necessary to ensure compliance, to deter non-compliance and to recover revenues (See Back Office/Enforcement).

Congestion charging must be implemented within a clear policy framework – bearing in mind that:

The technology options for charging and the operations strategy are defined by the congestion charging policy.

If the policy changes in the future – the technology and operations strategy may also need to change. For example, if a policy goal is to support increased use of low emission vehicles and discounts are provided on their use in the congestion charging zone - there must be some means of ensuring that only low emission vehicles receive the discount. This may require establishing a database of vehicles registered for the scheme and their emission classes.

Any congestion charging system must be planned so that it can be ‘scaled’ up in the future. The most common changes are likely to include variations in discounts offered, increasing the geographic area of the charging zone, enabling interoperability with other charging schemes (or tolled routes) – and the use of more tags or OBUs(See Standardisation & Interoperability Issues).

The alternative strategies to pricing as a demand management tool include:

Figure 6: Mixed traffic conditions, Delhi, India

US Federal Highways Administration, HERS-ST Highway Economic Requirements System - State Version: Technical Report, Appendix C Demand Elasticities for Highway Travel: http://www.fhwa.dot.gov/asset/hersst/pubs/tech/tech11.cfm

Land Transport Authority (Singapore): http://www.lta.gov.sg/content/ltaweb/en/roads-and-motoring/managing-traffic-and-congestion.html

Transport for London (UK): http://www.tfl.gov.uk/cc

Swedish Transport Agency (Sweden): http://www.transportstyrelsen.se/en/road/Congestion-tax/

Transport for London (2003) Impacts Monitoring – First Annual Report, Transport for London (http://www.tfl.gov.uk/assets/downloads/Impacts-monitoring-report1.pdf)

Pickford A. and Blythe P. (2006) Road User Charging and Electronic Toll Collection, Ch2, Artech House.

Smeed R. (1964) Road pricing: The Economic and Technical Possibilities. UK Ministry of Transport, HMSO, London.

Vickrey, W.S. (1969) Congestion Theory and Transport Investment. American Economic Review 59 (Papers and Proceedings) pp 251-260.

Hau, T. D. (1990) Electronic Road Pricing: Developments in Hong Kong 1983-1989. Journal of Transport Economics and Policy 24 No. 2, May, pp203-214.

US Department of Transportation: http://www.etc.dot.gov/index.htm

Variable pricing is not primarily a response to congestion problems. Often on tolled roads, revenue generation is its main objective but variable pricing can also be introduced to reduce peak demand or to improve traffic flow, or both.

There is often pressure to invest in new road infrastructure or improvements that will accommodate peak demand. It can be attractive to recover some of the costs by introducing peak charges. The principles of variable pricing may also be applied to:

dedicated lanes that are partitioned from general purpose travel lanes – such as on State Route (SR) 91 in California (USA)

refine an existing tolling or congestion charging policy (See Toll Collection), HGV tolling (See Heavy Goods Vehicle (HGV) Tolling) or a congestion charging scheme (See Congestion Charging).

A successful variable pricing policy needs to be clearly understood, lawful, acceptable and be seen to meet its original objectives. The policy should be clearly explained, including its:

Sustained support for variable pricing will depend on meeting expectations. Policies may be multi-level and include:

Charges for road use may be varied to enable a stated quality of service to be delivered – such as journey time on a specific road segment. Charges may be varied to reflect time of day or number of occupants in a vehicle or other criteria such as:

In every case the metrics should be measurable so that a vehicle may be checked for compliance. Fully automated methods may not always be feasible. For example, part-time manual roadside checks are necessary to check that vehicles using a HOT lane are compliant. In future (See Future Trends) it may be possible to count the number of occupants accurately by advanced image-based face detection systems or advanced in-vehicle sensors.

Most commonly, charges are varied according to a pre-set schedule – intended to maintain free flow traffic and reduce the likelihood of congestion. Charges may change every few minutes, hourly or monthly – or in real-time, based on stated criteria such as average vehicle speed. The fee varies according to a well-defined and well-understood relationship that can be measured.

A price that varies frequently may be unpopular with road users since it limits users’ ability to vary the time or their mode of travel. A simpler approach – that may be more understandable to users – could be a time-of-day variation that is reassessed annually.

A variation in fee does not always mean an increase in the fee. It may be reduced as an incentive to change behaviour instead. For example, the tolled portion of the Gauteng Freeway Improvement Project (GFIP) administered by the South African National Roads Agency (SANRAL) offers a discount of up to 30% for travel during off peak periods. Alternatively a ‘revenue neutral’ approach may be implemented. This is based on increasing fees during peak periods and reducing them at other times – with the aim of ensuring that the same total fees are collected daily.

Examples of variations of a fee and its associated metrics include:

As with tolling and congestion charging, the variable pricing policy defines the operational strategy and the technology and system requirements. The technologies, data and resources that enable the tolling and congestion charging are also relevant to variable pricing (See Toll Collection, HGV Tolling and Congestion Charging).

The criteria around which prices vary must be measurable – ideally automatically. For example, an operational strategy that varies price to maintain free flow traffic needs to be able to measure the average travel time or the density of vehicles on a precisely defined length of road. This can be done using vehicle detectors (See Vehicle Detection) or by measuring the average journey time (See Journey-Time Monitoring).

Electronic payment systems facilitate payment on public transport and enable integrated transport strategies allowing travellers to use a common method of payment for all public transport modes on all operator’s routes (See eCommerce).

Valid Methods of Payment (MOP) are based on technologies which are regarded as secure and trusted – and meet minimum technical standards that enable them to be read by a variety of readers. They include:

Electronic forms of passenger fare payment are widely in both developed and developing economies. Removing cash payments at the point of use or boarding of the transport service can have several benefits.

For travellers, the benefits include, convenience and access to new services:

For transport service providers, the benefits may be:

The success of a passenger fare payment system can be judged by its usage and the proportion of travellers using it.

The widespread deployment of a non-cash method of payment for passenger fare payment – and the interoperability of the method of payment across modes – is essential to supporting the development of efficient public transport networks in cities worldwide (See Standardisation & Interoperability). Cities that operate integrated transport networks with common methods of payment include Auckland (New Zealand), Cape Town (South Africa), Hong Kong (China), London (UK), São Paulo (Brazil), Stockholm (Sweden), Washington (US) (See Integrated Multi-use/Intermodal Ticketing).

Proximity cards, smart cards and more recently mobile phones – as Methods of Payment, (See Methods of Payment) are portable payment transactions that are secure. They can be used to access a wide range of public transport services simply by touching or waving the method of payment near a reader located:

In most cases the reader displays the amount debited – and, if the method of payment is linked to a prepaid account, the updated balance can also be displayed.

Travellers can use their mobile phones to access information services, to obtain advice on the best fare for a trip, the best time to travel – and availability of seats. By combining traveller information services with the location of the mobile phone user, it is possible to offer advice on a combination of modes that meets the user’s requirements for journey cost or duration.

Advances in location-based services are being driven by 3rd party service providers, enabled by the mobile phone’s ability to estimate a user’s location outside of, or deep within, buildings. These developments include Cell ID, WiFi network mapping against stored databases, GNSS and Bluetooth-based beacon technologies. The ability to deliver information to a user’s mobile phone at known locations enables more relevant and timely travel services. These positioning technologies also enable a bus-ticketing machine to calculate the fare automatically, based on the vehicle’s position on the route or its distance travelled. Other innovations associated with advanced fare payment on express / long-distance coach services include real-time calculation of ticket prices for seat reservations to enable effective yield-management and capacity-management.

Myki Card Reader, (Melbourne, Australia)

The critical success factors for an electronic payment system include the widespread:

Ideally, the payment top-up options should be responsive to the different needs of occasional and frequent users. For example, the London Oyster card scheme, caters for both – infrequent users can top-up their accounts at numerous locations across the city, whilst frequent users can also benefit from on-line facilities.

One means of achieving integrated transport is to require all transport operators participating in a scheme to use common technical standards and operational specifications and codes of practice (See Standardisation & Interoperability).Travellers are then able to use the same card for all transport modes and for other services (See Value Added Services).

Since cards do not have to be registered to a person, it is possible for the method of payment to be transferred between friends, family and relatives. This may be a deterrent to implementing discount schemes for frequent travellers unless a registration scheme is in place.

Trials and pilots of new methods of payment (for example, the pilot in Hong Kong of NFC-equipped mobile phones that behaves like an Octopus card) demonstrate that a transport service provider should provide a variety of MOPs to ensure that the majority of users’ preferences are satisfied.

The most common service upgrade is to:

The evolution of large scale electronic payments systems may also require the introduction of new payment service providers such as credit card companies or Mobile Network Operators (MNOs) that wish to charge their account holders for public transport use by using their credit cards or mobile phones as the MOP. Transport for London (UK) is piloting the use of 3rd party wireless credit cards as a MOP to pay for public transport.

Electronic payment systems facilitate inter-modal transfers – and are a key feature in an integrated transport strategy, which may include on-street or off-street parking facilities.

Smart cards and proximity cards can be used as a means of payment at on-street parking meters. These methods of payment can also be used to record time of arrival/entry – and to regulate access to off-street car parks, such as in cities and at airports – if the necessary equipment is installed and operator agreements and back-office processes are in place.

Mobile phones (as a payment platform for parking) may be used to register a Vehicle Registration Mark (VRM) at a specific location, with a parking service provider. Traffic wardens (or an ANPR-assisted back-office arrangement) can cross-reference the permitted list of vehicles registered for parking within the location, to ensure that each vehicle is associated with a parking account (or a valid method of payment). Tags or more sophisticated OBUs may also be used as a method of payment or to identify an account to be charged. In the future satellite navigation (GNSS-based OBUs) may be used to automatically record entry and exit to on-street parking zones – and to enable the total charge to be calculated and billed (See Toll Collection).

In summary, there is a broad range of payment options for on-street and off-street parking. Examples where smart cards, DSRC (or RFID) tags proximity cards or mobile phones (used as a payment platform) may be used as a method of payment for parking payment, include:

The successful implementation of a non-cash method of payment for parking can be judged by the proportion of parking fees that are paid using it.

An Octopus-based parking meter, Hong Kong

A non-cash method of payment, such as a tag, OBU, smart card, proximity card or mobile phone (to provide the payment platform), may be used for on-street and off-street parking. Users are required to take some action to register the vehicle with its location and a valid means of payment. This may include:

If a parking operator wishes to attract customers that are also users of a nearby ETC scheme, the parking operators’ electronic payment systems will need to be interoperable with the ETC scheme. An arrangement of this type will require a commercial agreement between the operators – as well as a data link so that payment records can be transferred every time an ETC account holder completes the parking payment process. Although not necessary, an ETC tag could provide a convenient method of payment for parking – in which case, charges would be billed to the ETC account. Alternatively, charges could be billed to a separate parking account.

A parking operator has the option of establishing its own method of payment – based on proximity cards, smart cards, mobile phones or tags. The cost and convenience to car park users of each method needs to be assessed against traditional paper ticket-based systems.

ETC systems which are made to be interoperable with parking facilities can be offered as value-added services (See Toll Collection and Value Added Services). Examples include:

In all cases, one of the most challenging issues is to reach agreement on the payment cycle. This is because:

Toll road operators may be reluctant to include parking amongst the services it provides to users, either because it increases their costs or simply because they do not want to complicate their core business. It may help if the management of accounts and methods of payment are kept separate from the service providers. In this way a toll road operator and parking operator would be separate but equal entities – in the same way as a credit card company views its varied network of retailers. The European Directive on Interoperability provides an example of organisational separation.

All EPSs need to be enforced. Implementing an electronic payment system for on-street parking needs sufficient resources for enforcement to ensure that revenues may be accurately and fully collected. Off-street car parks may use automated enforcement (such as a barrier) or a manual operator. Both methods are effective since vehicle entry and exit to an off-street car park is already highly restricted – most commonly to one entry and exit location. As with non-cash methods of payment for passenger fares, the removal of cash from the point of use of parking can lower the cost of operations, reduce queues to pay, and can help ensure that a system is auditable (See Passenger Fare Payment).

If parking is a Value Added Service (VAS) to a nearby ETC system, then changes to the ETC system operation and its method of payment may either force obsolescence (such as the end of a method of payment) or offer new opportunities (such as a new method of payment with a lower cost of implementation and operation).

Integrated ticketing is aimed at enabling a traveller to complete a journey using several public transport modes with a single, simple to use, method of cashless payment at an optimally low fare. Integrated intermodal ticketing helps smooth the process of switching between transport modes during a single journey. It can also increase the efficiency of the transport service as a whole if intermodal transfer points are planned as part of the transport network.

Overall, an integrated multi-use and intermodal ticket is an essential part of an integrated transport strategy.

Multi-use ticketing requires technical interoperability of the means of payment between services – but the primary challenge to deployment is organisational. A high level of cooperation and coordination is required to specify, implement, operate and expand schemes – and to ensure that a common method of payment is fully and comprehensively integrated and supported by the different operators of the various modes. (See Case Study: Integrated Multi-use Payment and Intermodal Ticketing)

The range of services that a user may wish to access are usually geographically limited but can be applied regionally, for example:

![Figure 9: MyCiti smart card validator, Cape Town (South Africa)] MyCiti smart card validator, Cape Town (South Africa)]](/sites/rno/files/public/wysiwyg/import/user-services/1439818819html_html_2ec48118.jpg)

MyCiti smart card validator, Cape Town (South Africa)]

Paper tickets or magnetic cards may be used for multimodal ticketing – but have limited security and limited validity (being generally linked to a single time period, such as a day travel card). The method of payment used by an integrated electronic scheme – to which more than one service provider belongs – requires higher levels of security, particularly if “typical” fares are higher for one mode than for others. For this reason, a strategic decision to implement integrated, multi-modal ticketing is unlikely to favour paper tickets or magnetic cards.

The primary enablers of integrated, multi-modal ticketing schemes are:

Since the operator of each transport mode needs to be paid for the service provided a commercial agreement is needed which defines the:

Large cities with many transport providers may offer several potential routes between any two points and complex fare structures, which may vary according to time of day and other factors. Multi-modal ticketing schemes can simplify a traveller’s journey using a common electronic method of payment. The chosen method of payment may be extended over time, to include additional transport operators (such as national rail networks), other cities or nationally. New methods of payment may be added – such as NFC-enabled mobile phones to provide additional choice to travellers. This evolution increases the complexity of operations and organisational relationships – but it is important that the method of payment remains simple for users to use.

It is recommended that transport service providers planning to deploy a method of payment to improve their operations should consider how the deployment will be managed and the expected cost-overhead of operating the method of payment (See Passenger Fare Payments) They will also need to consider, whether the method of payment can successfully be extended beyond the original transport service and its geographical area.

To enable scaling, emerging trends for specialisation suggest – that other providers such as banks or credit card providers could also provide a method of payment and related back office services. An example is the introduction of Contactless Payment Cards alongside the Oyster proximity card, in London. A key point to bear in mind is that the duration of any secure transaction must be fast enough to minimise congestion occurring in transaction processing (See Future Trends).

Keep Things Simple

A traveller that uses a mobile phone for payment transactions cannot reasonably be required to enter a personal identification each time they board a bus, even if a bank would normally require this for the purchase of goods.

The speed at which innovations in EPS will be expanded beyond a single MOP will depend mainly on agreement reached between banks, retailers, mobile network operators, EPS device manufacturers and advertisers. For example, it is now possible to host a proximity card application as a ‘co-resident’ application in a credit card (such as in London) or mobile phone (such as in London and pilots in Hong Kong).

MyCiti: (http://www.myciti.org.za/en/home/)

Octopus: (http://www.octopus.com.hk/home/en/index.html)

Oyster: (https://oyster.tfl.gov.uk)

Myki: (http://ptv.vic.gov.au/tickets/myki/)

EZLink: (http://www.ezlink.com.sg)

Swiss Pass and related products: (http://www.swiss-pass.ch)

Transport for London (August 2013) Going cashless on TfL bus services (consultation) (https://consultations.tfl.gov.uk/buses/cashless)

Transport for London (July 2013) Annual Report and Account 2012-2013, p36

A service that is provided to a road user, in addition to the core business of operating the road network, is known as a Value Added Service (VAS). As part of a value-added service strategy, the use of a common electronic method of payment can be extended beyond multi-use integrated ticketing – to making other payments for complementary services. This could include purchases and discounts at hotels, museums and local retailers. (See Location-based Services)

A value added service can also be provided by a road toll operator (or third party account service provider) – by enabling the equipment required to pay for the toll (RF or DSRC tag) to be used to pay for parking, other services or purchases.

Transport operators can gain valuable information on how travellers use their service by monitoring the payments made. Data on the origin and destination of a trip (recording the location of entry and exit to the transport network) can provide information on the growth in demand for each mode – as well as the cumulative demand on the transport network. This can be used to inform the rescheduling of bus routes or to justify long-term capacity enhancements to a light rail service – ensuring that adequate capacity is delivered at the place at the time. The information can also be used to identify opportunities for other services that could be offered in the future.

A record of any payment provides essential information on how and where a person makes the payment, and offers the opportunity for further customisation of services to individual users or all users. By establishing business relationships with other organisations, service providers of common electronic methods of payment, can extend the scope of the method of payment to cover payments for goods and services provided by those organisations.

Every time the method of payment is used in a value added service – for example at a retailer – the retailer transmits the record of the transaction to the service provider of the method of payment for settlement, after deduction of any transaction charge that may be levied by the service provider.

The development of value added services depends on the level of detail and the period over which data is collected, the sophistication of the analysis, inter-organisational data exchange methods, general commercial terms and periodic reporting of demand for the services offered.

The main challenge to developing a value added service is to define a feasible business case that allows a service provider (such as a toll road operator) to:

Interoperability of technology and back-office processes can enable this since it allows the operation of the toll road or public transport services to be separated from the administration of accounts. This offers economies of scale – enabling a wide range of additional transport or non-transport services to be provided, supported by a single back-office operation (See Standardisation & Interoperability) Practical examples of this include:

To maximise the use of common electronic methods of payment for public transport, some service providers offer them without the need to register for an account.

The advantage of encouraging users to register for the method of payment, is that it enables additional added-value services to be developed and offered to users. This could include:

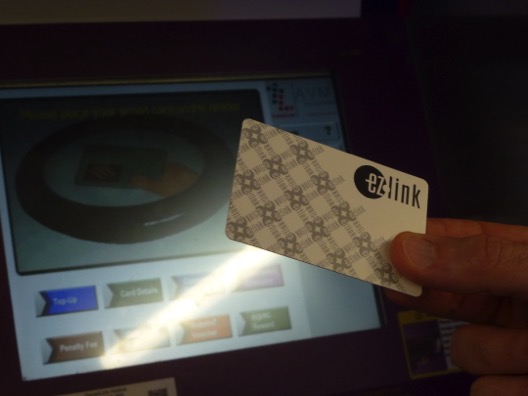

Adding value and checking balance of an EZ-Link card, Singapore

Octopus: (http://www.octopus.com.hk/home/en/index.html)

Swiss Pass and related products: (http://www.swiss-pass.ch)

Electronic Payment Systems (EPS) bring together telecommunications, data processing, data storage and microcomputer technologies and apply them to the process of revenue collection, record keeping and funds transfer. In general, the process can be divided into:

From the point at which a payment is initiated details of the event need to be transferred securely to the organisation that manages the back office to credit the payment to the organisation that provided the service. The process chain depends on agreement on:

Payment starts with an action by the user to show that he or she is eligible to access a service or liable to pay the toll or charge. The payment is done by the user paying directly or alternatively by providing an identifier that is linked to a user’s account which is charged. The MOP is the combination of transactions necessary to perform the payment and identify the account to be charged (See Methods of Payment) For example:

Vehicle detection, automatic location, communications, and security mechanisms all contribute to determining when, how, and how much to pay for the use of a transport service or road infrastructure. For example, many examples, such as toll collection, off-street parking and access for HGVs at a port, depend on the presence of the vehicle and so vehicle detection and measurement are critical. Tolls and charges may vary according to the vehicle’s location, so that the ability for a user (or a road operator) to know the road on which the vehicle is being used is important.

All Electronic Payment Systems (EPS) require some form of data capture and temporary storage as part of the information chain – from the event that triggers a payment to completion of the payment transaction. The event can be:

Each transaction needs reliable data capture and secure data transfer (See Supporting Technologies).

Other factors that need to be considered in the design and implementation of an EPS include:

The financial viability of every electronic payment scheme depends on being able to collect revenues owed and to deter non-compliance. This involves checking that all transport network users comply with advertised regulations. The back office will process the payments, match payment events with accounts, provide enquiry services, interface with the banks – and take on many or all of the functions required to perform enforcement operations.

Traditionally, the back office for a single public transport operator would support cash payments and a branded proximity card used for electronic ticketing. An integrated public transport payment scheme might additionally need to deal with bike hire, taxis, national rail lines and the transport providers in other towns and cities.

The back office for integrated transport needs to grow to match the complexity and range of services offered. New organisational arrangements may be required to enable multiple shared Methods of Payment (MOPs) managed by a variety of service providers – for example mobile network operators, banks and other institutions that already have many of the back office functions in place. There are organisational models for Electronic Toll Collection (ETC) that encourage this, such as the European Electronic Toll Service (See Enforcement and Back Office Arrangements).

The take-up of electronic payment for different transport services may reach a point where there is a need to harmonise different Methods of Payment (MOPs) so they can be offered across alternative transport modes, between different transport operators and allow travellers to access complementary services. The challenge is to establish interoperability, which may require agreement to harmonise different payment systems at the technical, contractual / legal and business levels (See Standardisation & Interoperability Issues). Videos: How Electronic Tolling Works on NH-8 & Interoperable Electronic Toll Collection

“Method of Payment” (MOP) is a term used to describe the means by which Electronic Payment Systems (EPS) complete the payment transactions. In general, the payment process can be divided into ‘front end’ activities – in which the user participates – and the ‘back office’ responsible for account maintenance, transaction processing, revenue management and settlement, customer relationship management (CRM), enforcement operations, reporting and auditing.

A number of technologies have been adapted to act as the front end for an MOP and are in widespread use:

The most common MOPs are those that are carried by people (mobile and personal technologies) or which are vehicle-based – such as a tag (or OBU) or an externally readable identifier such as a vehicle’s number plate. In addition, there are important supporting technologies that are applied, for example to measure a vehicle’s use of the highway, including vehicle detection, automatic location and communications.

Other critical ‘enablers’ include human factors and security mechanisms, introduced below.

Wireless communications play a part in most Electronic Payment Systems. For example they may be used by a toll tag to communicate to a roadside system or terminal the identity of an account and – depending on the application – the value of funds held in the account or card. This has to be done in a secure manner without risk of compromise. The widespread use of these technologies has means that standards are critical to define the data stored, the mechanisms for data transfer, security requirements and the maximum time permitted for the transfer (See Electronic Payment).

So-called “contactless” smartcards or proximity cards make use of wireless Near-Field Communications (NFC) over a range from a few millimetres to a few centimetres. They are commonly used by travellers carry to pay for services and regulate entry to metro rail networks, to access an off-street car park or to pay a fee at a parking meter.

Tags installed on vehicles have a longer range. For electronic toll collection Radio Frequency Identification (RFID) and Dedicated Short Range Communications (DSRC) tags are used with a range from 5 to 10 metres.

Proximity cards are an attractive means of payment for high volume mass transit systems because of the speed of payment and convenience for the user – see below. Depending on the application, these have a very short range (such as up to 10 centimetres) and a rapid transaction time (much less than half of one second).

Smart phones are gaining ground as a means of payment for public transport, such as on buses, trams and subway services (See Passenger Fare Payment) provided that minimum performance requirements are satisfied.

Using an NFC-equipped mobile phone at a turnstile of a metro station - simulated

A toll tag or On-Board Unit (OBU) for electronic payment can be one of two types:

The term OBU can apply to a tag but is usually applied to a more sophisticated in-vehicle device, perhaps including some combination of a card reader, display, keypad or a satellite receiver – to enable the OBU to determine its own position and perform some calculations to determine road usage. It is one of three main components of a vehicle-related Electronic Payment System:

In most toll applications the toll tag or OBU is usually secured behind the rear-view mirror as in the Figure below. Generally tags have a footprint similar to a business card and range in thickness from 1 millimetre to about 15mm depending on the communication technology and application.

Figure 12: Example of a DSRC toll tag (Australia)

The toll-tag or OBU relies on low-power Radio Frequency (RF) or microwave energy to communicate. When the tag passes through the capture zone of the roadside antenna, the tag transfers information wirelessly to be processed by a computer system. The correct account is charged or, if the tag includes a smart card, the card may be debited. For example the South Korean Hi-Pass national ETC scheme uses an RF tag that accepts a smart card as an electronic purse, that may be reloaded at banks with amounts upwards of KRW 10,000 (c. USD 9.5).

Electronic Commerce (eCommerce) is defined as the systems and activities that enable the purchase of goods and services via electronic channels, already widely implemented through the Internet for users at their personal computers (See eCommerce). More specifically relevant to ITS, Mobile Commerce (known as ‘mCommerce’) refers to the use of mobile devices such as mobile phones as payment platforms to access or purchase transport-related services. A mobile phone is already regarded as a relatively secure device, many of which are equipped with a Security Identification Module (SIM) to establish a contractual connection to the network of a Mobile Network Operator (MNO).

Smartphone applications are already used as a MOP for an Electric Vehicle located at a specific charging point – shown below. The application may also provide other services such as displaying the location of available charging points and remote reporting of the charging process itself.

![Figure 14: Mobile phone application to pay for Electric Vehicle charging services (USA)] Mobile phone application to pay for Electric Vehicle charging services (USA)]](/sites/rno/files/public/wysiwyg/import/user-services/1439818819html_html_520b8954.png)

Mobile phone application to pay for Electric Vehicle charging services (USA)]

A proximity card may also be used as a means of payment for at an Electric Vehicle charging station, shown below.

Octopus card reader at an Electric Vehicle charging station (Hong Kong)

Many electronic payment systems, such as toll collection, off-street parking and port access for HGVs are trigged by the presence of the vehicle itself. Some technologies for vehicle presence detection are also able to perform other vehicle-specific measurements. Examples are in-ground inductive loops and cameras with image processing software, both capable of classifying a vehicle. Sensors that depend on their deformation to sense a vehicle include treadles, capacitive sensors and piezo sensors, each of these formed into strips that are embedded into the road surface (See Roadway Sensors).

The configuration of non-contact, above-ground sensors depend on the desired location; laser scanners, radar and cameras may be used above traffic lanes whilst side-mounted optical light curtains and laser scanners are suitable for toll lanes. All of these rely on additional processing to properly interpret approaching vehicles and to reject objects such as pedestrians, animals and shadows and reduce the impact of rain.

Vehicles may be subject to regulations that depend on their location on the road network. For example, a national road user charging policy may be based on the distance that a vehicle has travelled, where charges also depend on the type of vehicle and road. (See Electronic Payment) To do this, a vehicle may be equipped with an On Board Unit (OBU) that is able to keep track of its own position based on detecting the signals received from GNSS satellites. The estimated position can be calculated within the OBU and the road segment then identified or, the required charge may be calculated at a back office by communicating the usage information instead – as shown below.

GNSS-CN On Board Unit for HGVs (Germany)

A charging policy may be based on a vehicle driving through a cordon into a controlled area (such as Singapore) or within an area (such as in London). It may be challenging to meet accuracy requirements where buildings or tall vehicles in an urban environment restrict satellite visibility. This effect (and the time to conduct a measurement) can be reduced if more than one satellite network – GPS, Galileo, GLONASS, BeiDou or a combination of all – is monitored at the same time. Alternatively, inertial sensors may be used to estimate the vehicle trajectory during the time that the GNSS signal is lost

The use of short-range communications for personal- or vehicle-based MOPs is described in the Section on Methods of Payment (See Methods of Payment).

Longer-range communication based on Cellular Networks (CN) provided by Mobile Network Operators (MNOs) may be used to gather data from OBUs in order to charge a road user’s account and to provide updated files (such as road maps) to an OBU. When used with GNSS-based position estimation, the combined technology is known as GNSS-CN. In addition, fibre networks, leased line or wireless communications may be used by roadside systems for tolling or enforcement to send vehicle identification records, data and images, to a back office for further processing. Handheld terminals to manually check HGV compliance would also use wireless networks for real-time access to vehicle databases.

All EPS require some form of data capture and temporary storage as part of the information chain from some event that initiates a charge. Examples are the presence of a vehicle presence in a toll lane, a user presenting a smart card at a turnstile to access a subway network, or a roadside enforcement system that captures an image of a HGV that is operating outside of permitted travel corridors.

The policies on data capture and management are critical to an EPS to ensure that it is secure, may be trusted and is of unquestionably high integrity that it may be used for compliance checking and (if needed) for enforcement. Some data does not contain anything that could be traced back to an individual (such as a radar image of a vehicle) but other data could be linked to an individual (such as a Vehicle Registration Mark, VRM). Data ownership, sharing, data types, sources of data, ownership, who’s entitled to it and general privacy issues are important aspects of any EPS deployment (See Privacy).

Security of data transmission is critical to ensure the financial viability and stability of electronic payment systems. Data may be subject to loss, intentional interception and tampering, spoofing (masquerading as a data source or receiver) and other attacks. Security mechanisms include watermarking (to detect tampering), encryption (to preserve confidentiality of the data) and authentication (to ensure that the sender and receiver are who they say they are) are critical to all EPS. Commonly, banking standards may be used to define the security requirements for EPS, particularly as the various MOP that are accepted by transport service providers would be expected to be in widespread use in the public domain.

The design and of devices and equipment needs to consider the interaction of people with EPS technology. The scientific discipline is known as human factors and ergonomics and applies to the design of in-vehicle equipment (such as tags and OBUs) and other MOP and payment platforms such as mobile phones and wireless smart cards (See Systems Approach and Design Process).

Mutual recognition of one or more Methods of Payment (MOPs) between different transport operators can enable the payment of tolls, public transport services, Electric Vehicle (EV) charge points, public cycle hire schemes and many other transport-related value added services. This flexibility is very attractive to travellers but requires a common – standardised – payment system and/or interoperability between different payment systems.

Interoperability aims to ensure consistency in the way that data is stored accessed and transferred between different MOPs and between the transport operators and payment service providers. It also enables a road user or public transport passenger to have confidence that his or her MOP will be accepted on a variety of transport modes.

Interoperability means that a MOP may be used without reconfiguration or modification to enable a road user or public transport passenger to pay for tolls, parking and public transport. Interoperability can be further developed to enable the payment of road user charges, Electric Vehicle (EV) charge points, public cycle hire schemes and many other transport-related value added services.

To establish interoperability requires agreement at the technical and contractual levels so that the significant societal benefits from interoperability may be delivered. A critical success factor in the implementation of interoperability is often a government body (a ‘champion’) that is able to focus on the benefits of society as whole (and not just individual operators), which may fund the development of interoperability specifications (for example: Chile, Norway and the UK)

Technical standards for EPS technology cover data exchange as well as equipment and communications. Standards aim to ensure consistency in the way that data is stored, accessed and transferred between a MOP and a reader, and between transport operators and payment service providers. Although standards are necessary, they are not always sufficient since a standard may have many options that may be selected and so some additional specifications sometimes known as ‘profiles’, may be needed.

Standards have been developed for tags used for tolling, such as Title 21 (generally California only), ISO-18000-6C and European Norm EN15509: 2007 (European Union) To confirm technical compliance, a MOP and the readers would commonly be subject to conformance test procedures, also defined by standards.

The world’s largest, multiple agency ETC scheme is E-ZPass that depends on a common proprietary single-source RFID tag (used as a MOP) supported by procedural and business level agreements amongst all participating operators known as the InterAgency Group, IAG. (See E-ZPass Group: Operating Agreement and Reciprocity Agreement (http://www.e-zpassiag.com).

For public transport, the most common standards are for smart cards – EMV (Europay, MasterCard and Visa) and MIFARE (a proprietary technology) for hybrid (contact/wireless) and wireless cards respectively. The Near Field Communication (NFC) standards embedded in cards and mobile phones are also used for MOPs, most commonly for public transport.

Certification processes can help ensure that equipment is safe and fit for purpose; open procurement processes are a means of stimulating competition.

With some exceptions, the challenges to establish interoperability involve reaching agreement at both the technical and contractual levels. Agreements are often use to describe operational procedures between organisations and, if this process is incomplete, it is possible that the benefits of interoperability may not be fully delivered, either to the transport service provider, to users or to both. For example, a group of transport service providers who wish to employ a smart card that complies with International Standards Organisation (ISO) / International Electrotechnic Commission (IEC) 14443 as a MOP that is to be issued and accepted by each provider will need to agree on:

Interoperability enables a single MOP to be accepted within and across modes. Adopting this policy can reduce procurement risk of MOPs by transport service providers sharing a common specification and can increase user choice amongst multiple competing MOP providers. If a single provider’s electronic tolling tag is usable at multiple locations then this would be de facto interoperability, but procurement risk depends on the delivery performance of one provider and there may be limited consumer choice of MOP variants.

An example of a comprehensive, multiple-service provider interoperability model is the European Electronic Toll Service (EETS) that separates the functions of toll collection, tolling account management and process governance, enabling organisations to specialise. In particular, Ireland has one of the most mature EETS schemes in Europe. (See: National Roads Authority (Ireland): http://www.nra.ie/tolling-information/)

In general, institutional barriers may slow down or prevent agreement on interoperability and therefore the most successful schemes are those that have addressed these. Efforts to ensure interoperability for Electronic Toll Collection (ETC) have not included procedures and evidential requirements for cross-border enforcement (for example the EETS definition does not include this).

Other challenges exist in establishing new services with incompatible competing standards such as physical interfaces for Electric Vehicle charging and transaction reports generated by GNSS OBUs to report road usage.

Overall, despite the many benefits to users of interoperability described here, the benefits to an operator may be limited, or there may be a net cost to the operators that could make it difficult to implement interoperability or prevent it happening at all.

European Commission (2011) Guide for the Application of the Directive on the Interoperablity of Electronic Road Toll Systems, available for download at: http://ec.europa.eu/transport/media/publications/doc/2011-eets-european-electronic-toll-service_en.pdf

CEN European Committee on Standardisation (2007) EN15509: 2007 Road transport and traffic telematics - Electronic fee collection - Interoperability application profile for DSRC, CEN (http://www.cen.eu )

International Standards Organisation ISO/IEC 18000-6C:2013 Information technology - Radio frequency identification for item management (http://www.iso.org)

California Department of Transportation (Caltrans) (2007) Compatibility Specification for Automatic Vehicle Identification Equipment (Title 21), Caltrans (http://www.dot.ca.gov/hq/traffops/itsproj/Title_21/title21_index.htm)

EMVCo, (2013) Integrated Circuit Card Specification for Payment Systems v4.3 (http://www.emvco.com/specifications.aspx)

EasyGo (http://easygo.com/en )

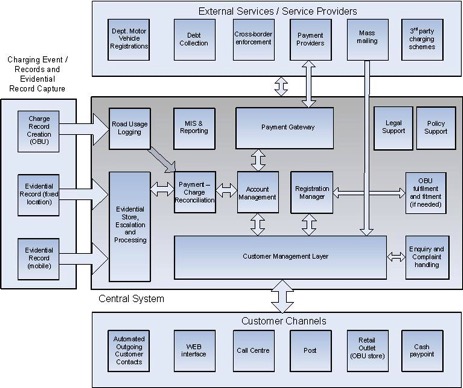

Back office processes match payment events with accounts, provide enquiry services, interfaces with banks and include many or all of the functions required to perform enforcement operations. Back office services include account management, enquiry handling, billing, legal support, interfaces to payment service providers and enforcement operations, shown in the diagram below. A back office represents a wide range of functions and administrative processes that follow well-defined business rules to create predetermined outputs meeting quality of service expectations.

Back office functions

Many travellers will already be familiar with the activities of back offices in non-ITS areas such as banking, cable TV companies, utility companies and mobile phone network operators. The back offices of all of these organisations provide services based on time and usage. They maximising the opportunities for customers to acquire these services and pay for them, denying the service to users that do not comply with regulations.

For EPS, the back office consists of the Information Technology (IT) and core functions on which charging, enforcement and all external interfaces depend. As cash is replaced by non-cash MOPs it becomes necessary to provide systems, procedures, human resource management, to deal with the collection, analysis and allocation of EPS events to payments made or to user accounts. In general the functions that comprise a central system can be split into several areas:

It is not necessary that all functions need to be provided by the same organisation; this would mean that every bus company or toll road operator would need to develop its own complete back office. Standardisation can enable interoperability which allows for the management of a MOP to be totally independent from the transport services providers (See Standardisation and Interoperability).

Enforcement is the means of ensuring compliance with the regulations by deterring attempts at non-payment and providing the means to collecting outstanding payments. In most cases, the economic viability and sustainability of an EPS service depends on having an effective means of enforcement, which may mean using legal processes. If the accuracy of local or centralised database of vehicle owners is adequate then it becomes possible to reliably trace owners by capturing the image of a vehicle where there is non-payment (as evidence of a vehicle’s presence) which shows the Vehicle Registration Mark (VRM). This type of ‘evidential enforcement’ process needs to be trustworthy, secure and accurate.

One of the most effective forms of enforcement is to deny the delivery of a service to a user. For passenger transport a turnstile or gates may be used to ensure that a passenger needs to present a valid MOP before entering or exiting the public transport network. On a toll road and for off-street parking operators this means using ‘physical enforcement’ with barrier, as shown below, to prevent a vehicle entering or exiting a route until a valid MOP has been presented, including cash or some other form of identification. Alternatively, hydraulically operated bollards, as shown in the second picture, could be used to restrict vehicles within a city to specific types such as buses and taxis although these take many seconds to be raised and lowered.

Physical enforcement – barrier in a toll lane (Spain)

Hydraulically operated bollard – restricted vehicle access (UK)

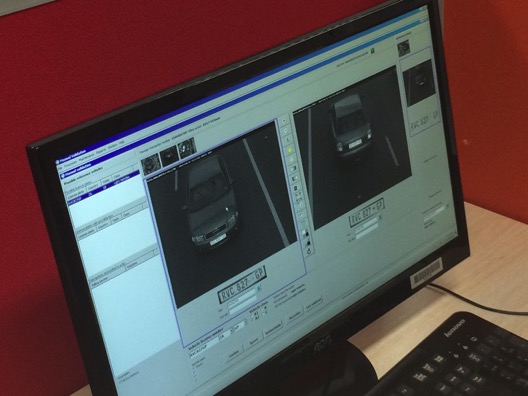

Although physical enforcement with barriers is an effective means of toll collection, it reduces the speed of vehicles and can only be used on the open highway without a toll plaza. Instead ‘evidential enforcement’ approach is necessary, based on overhead-mounted cameras shown below. The cameras are used to capture one or more images of any vehicles that is suspected of not complying with the regulations governing the use of the road – such as a vehicle that is not equipped with a tag, shown in the screen display in the second photograph.

Back office functions relating to camera enforcement include manual image interpretation, image storage, general legal support and image viewing facilities for staff authorised to issue fines or penalties. Note that an image of a vehicle may be regarded as ‘personal data’ and its use may be subject to local regulations on data protection (See Privacy).

If the toll road operator offers users’ accounts that are linked to a vehicle’s number plate, overhead cameras could perform the dual roles of video tolling and enforcement against non-payment. Optical Character Recognition (OCR) is used to interpret each image to extract the Vehicle Licence Plate Registration Mark (VRM) by a camera that is capable of Automatic Number Plate Recognition (ANPR) or the back office, or a combination of OCR at both, to allow enforcement to be partially automated such as the check of national vehicle databases.

An enforcement camera and related illumination source (Taiwan)

Images of vehicles front and rear number plates and related metadata

For truck tolling, enforcement against non-compliance may require a combination of fixed roadside systems, illustrated below, that combine all of the technologies described above. These methods may be reinforced with plus mobile patrols with vehicle-mounted or handheld equipment to interrogate the On-Board Units and capture Licence-plate. Transponders with visual or audible indicators are sometimes used to signal to the driver that he is permitted to bypass a weigh station without stopping based on historical compliance (as used in the US). At border crossings within customs unions, or on the approaches to weigh stations, the aim is to optimise inspections with the need to keep traffic moving (See Enforcement).

In 2014, Norway mandated the fitment of DSRC transponders on all HGVs to improve compliance checking, an advantage for enforcement operations in harsh weather conditions.

Static compliance checking for HGVs (Switzerland)

A successful Electronic Payment System is one that is widely adopted for transport-related services. This is likely to mean that a number of organisations will need to cooperate to deliver a comprehensive transport service, to a population that may have little or no experience of non-cash MOPs and where internet usage is low. Lack of expertise may prohibit a local authority or private toll road operator from selecting the most appropriate MOP or developing a procurement specification for back office services – particularly where interoperability is needed. Consultation with those who have been involved in commissioning comparable projects elsewhere is recommended.

Regions that have a high proportion of users on public transport offer a potential for successful use of non-cash MOPs. Examples are:

Operationally, the critical components of an effective enforcement regime are:

Historical data based on levels of compliance according to location, a vehicle rating system or other metrics can be used as the basis of ‘intelligence-based’ enforcement to ensure that scarce resources are used effectively. The same approach can be used for enforcement of HGVs route adherence and to reduce instances of cabotage by foreign-registered vehicles –made easier if there is cooperation with neighbouring countries.

Innovations in transport policy are seeding innovations in the technologies used for Electronic Payment Systems (EPS) and their applications. For example:

Other changes are a consequence of technological progress. Interoperability means that a Method of Payment (MOP) may be used for more services in a greater number of locations. Interoperability also paves the way for 3rd party payment service providers, allowing road operators and public transport operators to focus on their main business of improving the delivery efficiency of their own transport services (See Intelligence in Transport).

Technologies that enable data storage and secure communications also enable improved process accuracy, integrity and auditability – critical components of any EPS. Advances in mobile telephony include increased geographic coverage and the emergence of smart phones, with new communications media such as Near Field Communication (NFC) and Bluetooth Low Energy (BLE or Bluetooth 4.0). All this means that more individuals can now access public and private transport services to plan their journeys at any time, wherever they are located, and pay for such services with a mobile phone.

Current trends from developed and developing nations suggest that travellers have never been better informed on the status of the road network, modal choice, expected costs and journey times. The successful and broad introduction of non-cash MOPs for tolling and public transport services have also accelerated the development of customer relations, not previously possible with cash-based payments. The same trends mean that transport service providers are also better informed about their customers.

Trends in transport policy may lead to a radical revaluation of how roads are financed. A nationwide ‘user pays’ policy is now possible based on EPS applied to paying a fee to use any public road, differentiated by Time, Distance and Place (TDP). This approach requires the location of vehicles to be estimated accurately enough to ensure that a user pays the correct fee – and the same fee for repeated journeys. Continued developments in satellite-based positioning means that a vehicle can be now equipped with an On Board Unit (OBU) that will estimate its own position from triangulation with one or more satellite constellations. The OBU determines the section of the road on which the vehicle is travelling and whether it lies within a charging zone.

Recent developments provide confidence that road user charges may be accurately based on time, distance and place in the urban environment as well as on interurban roads. This may enable alternative means of taxing the ownership and use of vehicles – potentially a replacement for traditional taxes on vehicle ownership and on fuel. Trials were conducted in Singapore from 2012 to 2013 and also in Puget Sound, USA. (See: Traffic Choices Study – Summary Report 2013 by Puget Sound Regional Council, available for download at: http://www.psrc.org/assets/37/summaryreport.pdf)

Charging for road usage has been applied to Heavy Good Vehicles (HGVs) operating in Switzerland since 1999. In future on-board equipment for measuring the mass of a vehicle’s load could enable HGV movements to be regulated based on actual weight rather than a manufacturer’s declared weight. By way of example, regulations that include an allowance for measured mass are to be included in the Intelligent Access Program (IAP), administered by Transport Certification Australia (TCA). (See: Intelligent Access Program http://www.tca.gov.au/certified-services/ia)

Other developments for HGVs could ensure efficient utilisation of restricted routes and loading / unloading areas, by requiring HGV operators to reserve loading bay spaces(See Operations & Fleet Management). This has been demonstrated in the European Cooperative Vehicle Infrastructure Systems (CVIS) project.