Advisory systems include a broad range of ITS applications that provide information to the driver about traffic, weather, road conditions, parking data and in-vehicle presentation of roadside signage – to help plan and undertake the journey.

Driver information includes a suite of solutions that have evolved rapidly over the last few years, across areas as diverse as route finding, availability of parking and electric vehicle charging stations, and management of driver behaviour. The increasing levels of connectivity that are available in the vehicle as a result of smartphones and embedded in-vehicle communications – are a key driver of this evolution. Market penetration is not universal – but many more people have access to these services than ever before and the numbers continue to grow.

In response, existing services have developed new capabilities – and new services have been launched in the market. This has great potential in terms of the tools available to both road network operators and drivers to promote safer and more efficient travel. They include:

A wide range of technologies and applications are now available to help drivers manage their travel. Some are being developed through private sector innovation. Others rely on public sector infrastructure and data. From a road network operator perspective, it is important to:

One of the biggest challenges of connected solutions of any type – is consumer privacy and data security. Local laws and cultural tolerance for data-sharing must be carefully considered. (See Data Ownership and Sharing)

Driver services provide assistance to drivers faced with various scenarios (emergency and convenience). These services will often benefit road network operators and their partners on the road network. For example, Roadside Assistance and eCall services can help to ensure that breakdowns and accidents are quickly reported and cleared. Stolen Vehicle Recovery services may reduce the police work needed to handle vehicle theft.

Deployment of services – such as eCall – has the potential to save many lives every year. It is a complex undertaking that requires the cooperation of a large number of public and private sector partners – from emergency responders to equipment manufacturers. Service developers need to be aware of lessons learnt from early eCall deployments to ensure that technical, legal, and institutional issues are properly addressed.

Data collected from vehicles can enable a broad range of applications – including measuring travel times and providing real-time weather data. Vehicles used to collect data are known as “probe vehicles” or “floating vehicles.” For example, when the location of a moving vehicle is known at different times at two different positions on a road link – the travel time on the link (or “link time”) can be measured directly. Tyre slippage on an icy road and moisture on the windshield can also be detected and reported to the traffic centre by the vehicle – together with its location. This data can refine, replace, or add to traffic and weather data generated by fixed sensors. (See Probe Vehicle Measurement)

Probe data is a well-established tool for building a real-time picture of the road environment – and can help with planning road network operations. A recent addition to the road network operator’s toolbox is passive probe data collection (anonymised) – using roadside equipment for monitoring toll tag readers or Bluetooth equipment in the vehicle. Data actively collected by fleet owners as part of their operations is currently underused by road network operators because of:

The rapid market penetration of smartphones world-wide has provided a highly capable new platform for the dissemination of travel information and access to other services. It has also transformed consumer expectations – that the information they want should be immediately available. This has accelerated the concept of Open Data – where data that is collected at public expense is made available to anyone to use – stimulating a market in, for example, traffic and travel information applications. (See Open Data and Case Study: Open Data UK) Car manufacturers have also responded to this trend, offering various ways of linking smartphones to vehicle audio equipment and visual displays.

Standards and standardised solutions are not available in all cases where applications rely on proprietary systems or smartphones to disseminate or collect information. Developers face the potential market challenge of working with multiple (non-standardised) development platforms.

Navigation and route guidance systems use satellite-based positioning and digital maps to offer drivers a selection of routes to their destinations. Drivers enter their destination and any route preferences – such as shortest distance or quickest route, or one avoiding toll roads. The system calculates the optimal route and provides instructions via screen displays or voice synthesis. Positioning is handled by:

Navigation systems originated as on-board and dedicated handheld devices – and have been developed to include on-line tools (such as access to traffic images from CCTV cameras on the motorway network) and real-time traffic information. The data was made available to mobile navigation systems using digital broadcasting – Digital Audio Radio (DAB) or (in Europe) incorporation of RDS/TMC traffic information codes. (See Basic Info-structure) Traffic data was displayed to the driver – or used to support automatic route re-calculation if sufficient congestion appeared along the route during travel (“dynamic route guidance”). (See Urban Traffic Control)

Today’s navigation systems include all of these options – and have built on them further by leveraging one and two-way wireless communications and cloud technologies in a variety of on-board, off-board and portable devices. This means that data storage, computing and location-finding may be powered by in-vehicle resources or by the cloud – which greatly increases the availability and functionality of navigation systems. (See Navigation and Positioning)

The new capabilities allow map providers to update maps much more frequently. It also enables map data to be combined with many other sources of static and real-time location-related information that may be helpful for travellers. For example, a navigation application on a smartphone may offer multimodal journey options – driving, public transport and walking – allowing users to decide on their departure time based on timetable schedules and driving time estimates.

The user interface in navigation systems has also improved over time. It is critical for safety that the use of navigation tools creates minimal driver distraction. Head-Up Displays (HUD) – which project information directly onto the windscreen – mean that drivers do not have to look away from the road to look at a screen embedded in the vehicle dashboard. The deployment of HUD solutions was initially limited by cost – but an increased number of vehicle manufacturers are either offering, or planning to offer them, in the near future. Augmented Reality (AR) systems – which provide location-specific information in a visual form overlaid onto digital maps – are also expected to be more widely deployed in the next few years.

Navigation systems typically select the quickest or shortest routes based on speed limits and travel distances. It is generally possible also to select routes for fuel-efficiency and reduced emissions, or other variables – such as the number of cross-traffic turns (which typically require longer engine idle times, and use more fuel). Fleet companies are early adopters of this approach to eco-routing – because it delivers significant fuel cost savings. Eco-routing also benefits electric vehicles – enabling them to achieve greater driving range distances on a single charge.

One of the key challenges to electric vehicle adoption is ‘range anxiety’ – a concern that the vehicle will run out of electric power in an area without charging facilities, leaving the driver and passengers stranded. This has stimulated the market to develop applications that provide information about the nearest charging locations and in some cases allow travellers to make advance booking at a charging station.

There has recently been a surge of activity in the consumer market – with original manufacturers’ equipment (OME) being installed and aftermarket devices (such as black boxes and alcolocks) becoming available. Their deployment is encouraged (or required) by insurance companies – in return for reduced insurance premiums to provide an incentive to develop good driving practices. The insurance community in Europe and the USA has been particularly active in this way – but projects are underway in many other countries as well, including South Africa, Japan, and Australia. (See Data Capture)

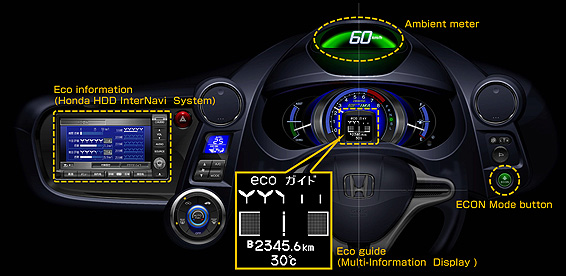

Eco-driving applications provide information about the impact of a driver’s choices – with the aim of encouraging driving patterns that are more environmentally sustainable. For example, some vehicle displays show fuel efficiency in real-time in response to driver acceleration and braking – as shown in the illustration below - In the future, a “connected” eco-driving solution might:

(See New Forms of Mobility and Smart Vehicles)

Honda EcoAssist system

These types of applications may in the future be integrated into systems – enabling:

Driver services were initially developed with the private sector in mind – but are now also widely deployed at the local, national and international levels – for example, eCall and stolen vehicle tracking.

The eCall concept builds on the roadside assistance using in-vehicle systems to automatically detect that an accident has occurred and call for help – a common indicator being airbag deployment. Implementation of the concept relies on capturing appropriate information from the vehicle and passing it to a local emergency responder. This can be challenging to implement:

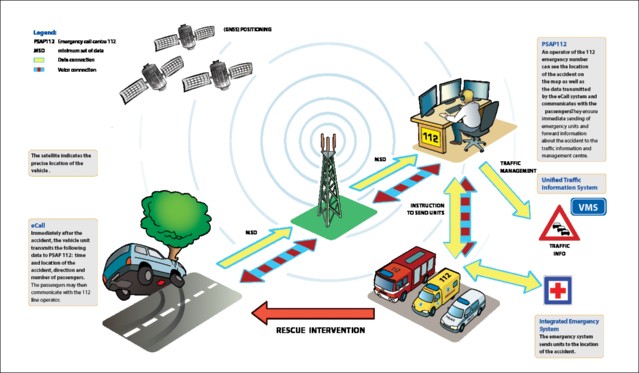

A great deal of work is underway to address these and similar challenges worldwide. The European Union’s HeERO project, has been testing and validating under real-life conditions, pilot tests using the common European eCall standards which have been defined and approved by the European Standardisation Bodies. (See http://www.heero-pilot.eu/view/en/home.html) The system uses GPS and digital cell-phone communications to automatically initiate a 112 emergency call to the nearest emergency centre to transmit the exact geographic location of the accident scene together with other data. The system is illustrated in the figure below - The European Commission’s target for deployment of the European Union’s eCall system is 2018.

HeERO eCall System

A vehicle owner can initiate tracking of a stolen vehicle if it is equipped with a location device, communications capabilities, the appropriate software and is registered with a recovery service provider. Alternatively, the vehicle may signal a problem to the owner if its location strays off-route or beyond a predetermined set of boundaries. This tracking information can be used by the police and recovery service providers. This technology and any associated services are used by vehicle fleet operators – particularly where fleets:

Brazil’s State Transport Department (DENATRAN) has been working towards mandating such systems through its CONTRAN 245 legislation.

Crowd-sourced data has become a valuable source of information as the use of smartphones becomes widespread. Users can actively – or by default – share information gathered during their trips with traffic and travel information (and other) service providers. This type of cooperation has helped to improve the detail of digital map data and real-time traffic and incident data. (See Mobile Reports)

Vehicles are being installed with sensor technology – which can provide detailed information about their environment. Major programmes for cooperative sharing of this information among vehicles and between vehicles and road network managers are being explored in Europe, the USA, Japan, and Korea. (See Coordinated Vehicle Highway Systems)

These types of data are an important resource for road network operators – where agreements can be reached on data access and sharing. It is also effective in handling real-time disaster situations. (See Case Study: Japan Cooperative Probe Data)

There are a variety of approaches to collecting traffic data from probe vehicles in order to analyse the resulting patterns:

The use of probe vehicles to measure travel time reliably faces three main challenges:

Collecting other types of probe data will often require closer integration of sensors and data reporting within the vehicle. For example, specific on-board devices and communications protocols are necessary to enable the appropriate capture and transmission of data such as windshield wiper activity or traction control system data.